|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Mortgage Interest Rates 30 Year Fixed: A Comprehensive GuideIntroduction to Mortgage Interest RatesMortgage interest rates play a crucial role in determining the overall cost of purchasing a home. A 30-year fixed-rate mortgage is one of the most popular options due to its stable monthly payments. Factors Affecting Mortgage Interest RatesEconomic IndicatorsInterest rates are influenced by various economic indicators including inflation, employment rates, and the Federal Reserve's monetary policies. Borrower’s Financial ProfileLenders evaluate credit scores, income levels, and existing debts to decide the interest rate for a borrower. Advantages of a 30-Year Fixed-Rate Mortgage

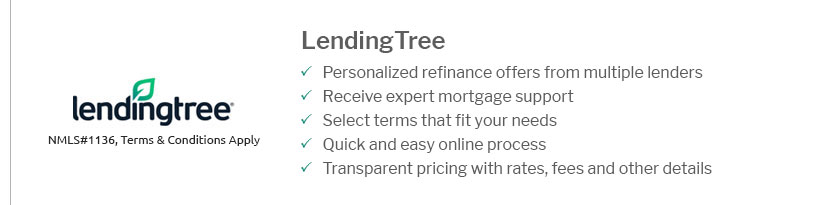

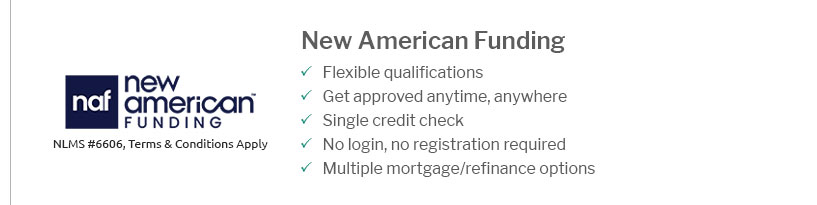

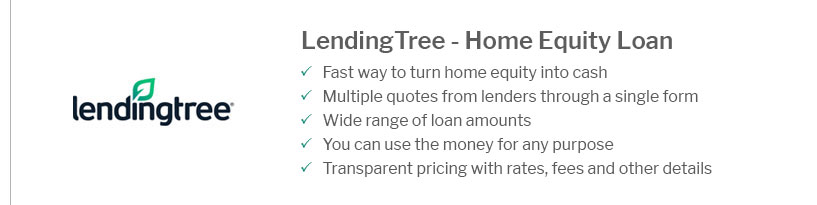

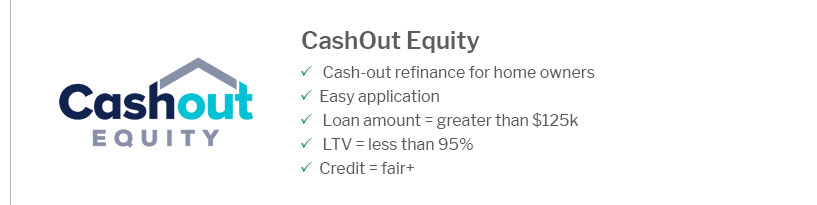

For more details on different mortgage options, consider visiting reputable mortgage loan sites. How to Secure the Best Mortgage Interest RatesImprove Your Credit ScorePaying off debts and maintaining a good credit history can help in obtaining better rates. Consider a Larger Down PaymentPutting down more money upfront can reduce the interest rate on the loan. Comparison with Other Loan OptionsComparing a 30-year fixed-rate mortgage with adjustable-rate mortgages (ARMs) and home equity lines of credit (HELOCs) is essential. For specific rates in different regions, you can check heloc rates california. FAQ

https://www.zillow.com/mortgage-rates/30-year-fixed/

National 30-year fixed mortgage rates go down to 6.82%. The current average 30-year fixed mortgage rate fell 1 basis point from 6.83% to 6.82% on Tuesday, ... https://www.bankrate.com/mortgages/mortgage-rates/

On Thursday, March 27, 2025, the current average interest rate for the benchmark 30-year fixed mortgage is 6.70%, falling 2 basis points since the same time ... https://www.nerdwallet.com/mortgages/mortgage-rates

On Thursday, March 27, 2025, the average APR on a 30-year fixed-rate mortgage fell 2 basis points to 6.809%. The average ...

|

|---|